Business & Money

In VIC 89 I wrote about fixed costs vs variable costs as it relates to Facebook and SnapChat. If you missed that issue, the short of it is was that Facebook made a massive fixed cost investment up front in building its own data centers, with basically zero marginal cost as they add more users over time. In contrast, Snap uses Google Cloud for compute and storage, so there was no fixed cost investment up front, but adding incremental users over time means a proportional increase in operational expense.

The reason I bring this back up is because Spotify is preparing to go public via a direct listing. And like Snap, they have a massive problem with marginal costs. For every new user that signs up to Spotify and starts streaming music, that means more royalty payments to the labels. So costs rise in line with revenues and margins don’t improve. This is the opposite of how technology companies usually operate.

So, while the Spotify user base continues to grow at a healthy clip, it’s difficult to see how the economics of the business make any sense. With over a billion dollars in losses, it’s hard to see a road to profitability.

So I’ll do something I never do, make a prediction. (I wouldn’t give much weight to what follows, but an interesting thought experiment nonetheless).

Scenario 1: Spotify goes public and the stock get’s punished over the next 12 months due to crappy economics. When the price falls far enough, Apple acquires them, kills the service, or simply rebrands it as Apple Music while killing their own. This removes the largest competitor in the market and gives Apple more strategic leverage in negotiations with labels, which has the potential to make streaming music a potentially profitable business.

Scenario 2: again, Spotify goes public and the stock get’s punished over the next 12 months due to crappy economics. The major labels see this and recognize an opportunity. They all come together and form some type of joint venture or SPAC (special purpose acquisition company – a publicly traded company who raises money via the public markets with the sole purpose of buying another company) for the purpose of acquiring Spotify (similar to the way Hulu is a joint venture between Disney, Fox, Comcast, and Turner).

There is, of course, a pretty clear bull case for Spotify, but they have their work cut out for them. (perhaps we’ll touch on that next week)

Human Progress

Y Combinator (YC) is the top startup incubator in the land. I’m not sure if that’s the case in terms of realized returns, but it’s basically non-negotiable in terms of paper returns, brand recognition, and prestige. Their portfolio includes the likes of Airbnb, Dropbox, Stripe, Instacart, DoorDash, Twitch, Reddit, Coinbase, and many other household names.

The reason I bring them up is because, given their laser focus on seed-stage investing, they tend to see trends before others do. And as a result, I try to pay attention whenever they call out specific sectors they’re interested in.

As part of the YC application process, they sometimes issue an RFS, or request for startups. It’s an explicit invitation for startups to apply that are focusing on specific challenges or industries of interest to them. There are 25 categories on their RFS list, and they’ve just added 9 new ones. These are:

Cellular Agriculture and Clean Meat

Longevity and Anti-Aging (YC Bio)

If you’re working in or thinking deeply about any of these areas, perhaps you might want to consider applying.

Philosophy

I know a lot of people that see some form of a therapist. Unfortunately, I think there’s still a bit of cultural stigma associated with seeing a therapist, but I think that’s changing. In the last year alone, I’ve heard a number of people openly talking about their interactions with their therapist. I could not make that same statement 5 years ago. That is a good thing.

From my second-hand knowledge of therapy, it seems that one of the great things is that you get to openly discuss feelings and emotions. That doesn’t happen all that much in everyday life. It’s really easy to catch up with friends at happy hour or over brunch, without really diving deep into our emotional states and “peeling back the onion.” That’s unfortunate.

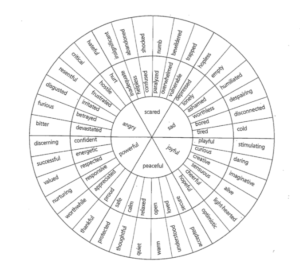

One person I know that attends therapy was given the below by their therapist as a tool to get to the core of emotional experience.

The outer wheels show the words that we often use to describe our feelings. The idea is to then move inwards in an attempt to understand what those feelings really mean. Are you feeling trapped and confused? Could that mean that you’re scared? If so, what are you afraid of?

Exercises like these seem like they could go a long way in helping us to be emotionally honest with ourselves and the ones we care about.

My Latest Discovery

Coinbase just launched an index fund. This will give investors access to a basket of all digital assets listed on their exchange, weighted by market cap. To start, it is only available to accredited investors in the US, but I imagine it will soon be available to the broader public. This is a great thing for crypto.

In the same way that average investors want access to public markets without the need (skill, desire) to pick individual stocks, this is all about expanding the addressable market for crypto and making it available to everyone.