Business & Money

I love the following parable that Howard Marks included at the end of his latest memo.

Suppose that every day, ten men go out for beer, and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes (by taxpayer decile), it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.So, that’s what they decided to do.

The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve ball. “Since you’re all such good customers,” he said, “I’m going to reduce the cost of your daily beer by $20.” Drinks for the ten men would now cost just $80.

The group still wanted to pay their bill the way we pay our taxes. So the first four men were unaffected. They would still drink for free. But what about the other six? How could they divide up the $20 windfall so that everyone would get his fair share?

The bar owner suggested that it would be fair to reduce each man’s bill by a higher percentage the poorer he was, to follow the principle of the tax system they had been using, and he proceeded to suggest the new lower amounts each should now pay.

And so the fifth man, like the first four, now paid nothing (a 100% saving).

The sixth now paid $2 instead of $3 (a 33% saving).

The seventh now paid $5 instead of $7 (a 29% saving).

The eighth now paid $9 instead of $12 (a 25% saving).

The ninth now paid $14 instead of $18 (a 22% saving).

The tenth now paid $50 instead of $59 (a 15% saving).

The first four continued to drink for free, and the latter six were all better off than before. But, once outside the bar, the men began to compare their savings.“I only got a dollar out of the $20 saving,” declared the fifth man. He pointed to the tenth man, “But he got $9!”

“Yeah, that’s right,” exclaimed the sixth man. “I only saved a dollar, too. It’s unfair that he saved nine times more than me!”

“That’s true!” shouted the seventh man. “Why should he get $9 back, when I got only $2? The wealthy get all the breaks!”

“Wait a minute,” yelled the first four men in unison, “we didn’t get anything at all. This new tax system exploits the poor!”

The nine men surrounded the tenth and beat him up.

The next day, the tenth man didn’t show up, so the other nine sat down and had their beers without him. But when it came time to pay the bill, they discovered something important: They didn’t have enough money between all of them for even half of the bill!

And that’s how taxes work. Tax breaks, quite naturally, flow to those that already pay the highest taxes. Raise rates too much, they get more creative (find loopholes) and take their money elsewhere.

Human Progress

In many (perhaps most) fields, veterans have stark advantages over rookies.

Sometimes the difference is structural. If you want to be an elite lawyer, doctor, or politician (is elite politician an oxymoron?), you simply have to put in your time and pay your dues.

Sometimes it has more to do with experience. Years in the trenches help you more readily recognize patterns and make better decisions.

But I love technology because it does not follow this model. If you come up with a novel new technology or business model, and you are adding real value for your customers, you can do well with almost no experience. It’s pretty 🍌🍌🍌!

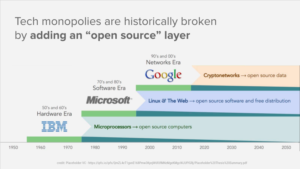

Think about when Netscape first rolled out the web browser. At the moment, rookies and veterans were indecipherable because the web browser was brand new for everyone.

The same thing is happening in crypto right now. There are high school seniors that are more adept at building decentralized applications on the blockchain then software engineers that have been working in their field for decades.

In technology, it almost pays to be a rookie, at least in the earliest stages of building something new. It’s the only way to truly think from first principles.

(of course, adult supervision can be a great thing when it’s time to scale)

Philosophy

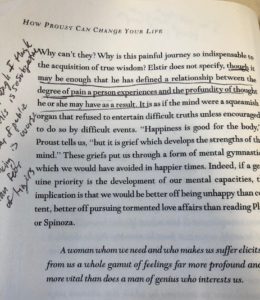

You’ve likely heard of the “golden rule.”

Treat others how you want to be treated.

To me, it made a ton of sense for a long time. Why would you do something to someone else if you wouldn’t like it done to you? Pretty straight forward.

But when you think about it more closely, the golden rule is ridiculous. In fact, I’d venture to say it encapsulates much of what is wrong with humanity. At the core, people are selfish individuals that can’t help but see the world from a first-person perspective. “Why wouldn’t everyone want to be treated like I want to be treated? After all, my views are right and true and pure.” 🤣

The reality is that people are different and have very different views about how they’d like to be treated. When I get frustrated, I like to be left alone. Quiet time and isolation are my preferred methods for reflection and introspection. Other people want to be comforted and asked if everything is ok. So to treat that person like I want to be treated is to neglect their emotional and psychological needs.

Lucky for me, my coach recently made me aware of the “platinum rule.”

Treat other people the way they want to be treated.

Makes FAR more sense!

My Latest Discovery

If you haven’t been to Koi in Bryant Park, do yourself a favor and go check it out! It’s a tad pricey, but the food is on point. Especially the crispy rice with spicy tuna!