Business & Money

What do you do when your sink is broken? Stupid question; you try to fix it. You might need to pick up a new part at the hardware store or tighten a few bolts.

How about your car? What do you do when one of those little lights on the dashboard turn on? If it’s something simple, like oil, you might be able to do it yourself. But for anything more complicated, you take it in to get serviced.

This simple logic applies to almost everything in life. Something breaks or stops working, you start twisting knobs, replacing parts, and doing whatever is necessary to rectify the situation.

But investing is different. What do you do when your investment strategy stops working? Or worse, starts producing negative returns? Is the strategy broken? Temporarily out of favor? Just experiencing normal volatility? Has a change in tax laws affected how the companies report earnings?

If you look at the following chart of Amazon (AMZN), all looks great!

But what would you have done when the stock went from $110 in December of 1999, down to $8 in October of 2001. Don’t answer. The overwhelming majority would shit their pants and sell on the way down. And it would have cost you some of the best returns in stock market history.

The same could be said for Berkshire Hathaway today. Buffet & Munger have regularly underperformed the S&P 500 for the better part of two decades. Is their value investing strategy broken? They would say no. They’re hoarding cash waiting for the next correction.

Don’t get me wrong, I’m not saying that a single strategy will work forever or that there aren’t times to change course. But the vast majority of people make far too many buy and sell decisions when the best strategy would actually be to do nothing.

And when you fiddle with things too much, you get in the way of compounding, one of the most powerful forces known to man.

Human Progress

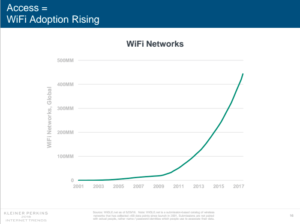

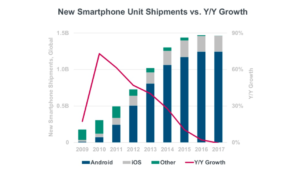

There’s something interesting happening in mobile. Smartphone shipments are basically flat YOY.

So, everyone who wants (or can afford) a smartphone, basically has one.

Combine that with the fact that global internet users sit at about 3.6 billion people, growing at roughly 7% per year.

And if the world population is around 7.6 billion, minus roughly 2 billion that are under 14 years of age according to the World Bank, that would mean that there are a remaining 2 billion people above the age of 14 that are not connected to the internet.

ISPs, telcos, and internet companies see that as a massive opportunity. But there’s a problem. Roughly 20% of the world’s population (1.6 billion) subsist on $1.25 per day or less. So these people won’t be buying smartphones any time soon (average selling prices hover around $300).

So this brings me to an interesting point. Here in the US, and other developed nations, the feature phone market is all but dead. You might find a few luddites holding on to feature phones, and there are certain models designed for children, but pretty much everyone has a smartphone. However, this is not the case in emerging markets.

Take India for example, where smartphone shipments were again flat YOY, but feature phone shipments grew by 48% in the same period.

I don’t have the data for Africa at my fingertips, but I’d imagine it would show similar numbers.

Google recently invested $22 million in KaiOS, a company that has created an operating system with the same name that comes with native apps and other smartphone-like services. (Of course, Google’s interest is self-serving in that the invest comes with the requirement that these phones come with Google Search, Maps, assistant, and other Google services built-in).

So, while the growth of internet users is now in single digits, and smartphone shipments are flat, there’s still a ton of work to get our fellow humans connected to the web, and tons of services to build on top of those connections for entrepreneurs across the globe.

Philosophy

How often do you unpack why you do the things that you do? I mean really unpack them to get at the true underlying causes.

Recently I sat down to journal about why I work out. Today, at age 29, it’s easy for me to say that I work out to stay healthy. I believe that operating at peak mental capacity means that the physical correlate must also be true. I believe that physical activity is important to maintain cardiovascular health, good circulation, and a healthy immune system. All things backed by lots of science.

But I was working out long before I cared about any of those things. When I really think about it, I land on a different reason altogether.

Standing at 5’8’’, I will always be one of the shorter men (and often people) in the room. And I’m perfectly ok with that fact now, but I’m not sure that was always the case. When I was younger, I think that being fast, strong, and muscular was a compensation strategy to fill in for height. I think the same can be said for my assertive personality. Better to not give anyone an inch psychologically or emotionally, given that they likely already had a few inches physically.

There are a whole host of other motivations and behaviors that I’m thinking about, but I thought I’d share this one with you guys this week. Perhaps it will be a catalyst for you to consider your own.

My Latest Discovery

My wife is constantly suffering from neck and back pain. So I constantly have to squeeze this one specific area on her neck/shoulders to temporarily relieve the pain (and I now suffer from hand pain as a result 😜).

So when I stumbled on the Body Back Buddy, I thought I would order it for her to see if it helped.

She’s a bit tiny for it (should have ordered the junior version – didn’t know about it at the time), but so far it seems to be getting the job done. Well worth the $30 on Amazon.