Business & Money

A couple weeks ago, the world lost John Bogle, the founder of Vanguard. For the unaware, Vanguard is the largest provider of mutual funds in the world and the second largest money manager when measured by assets under management.

But Bogle built Vanguard in an unusual way. To explain, let’s contemplate an unrelated industry for a moment.

In the energy industry, many investors focus their attention on the new shiny thing. They want to be involved in renewables, shale, battery technology and the like, all of which are exciting.

But from my perspective, the most exciting thing about the energy industry has been the massive efficiency gains. A 2019 Chevrolet Suburban has better fuel efficiency than a Ford Taurus from 1989. That’s an incredible leap in efficiency. If we get a similar gain in the next 30 years, and can keep fuel prices low, the transition to clean energy might be slower than anticipated.

Similarly, if you think about how to beat the market over the long term, you have 2 options:

You can outsmart other investors by timing the market and/or coming up with new and esoteric ideas.

Or you can aim for efficiency gains by spending less and saving more. (one of Bogle’s famous lines: “In investing, you get what you don’t pay for.”)

Bogle did the latter. He cut out brokers (and their massive fees) and sold funds directly to investors. And he sold these at cost so investors could keep more of their returns. And as a result of those lower fees, Vanguard funds outperformed the majority of asset managers.

And, of course, Bogle got extremely wealthy along the way, though not as wealthy as you might think. While the head of Fidelity is worth an estimated $7.4 billion, Bogle died with $80 million. And I think that’s because Bogle was more focused on his mission and less influenced by ego and greed.

Human Progress

I’ve written on this blog many times about the power of words and language. And I feel a need to return to the subject today. That’s because I keep reading about the concept of a “universal basic income”. I find both universal and basic to be troubling in this context.

I guess universal is being used here because, while the current welfare system is aimed at helping the very poor, the idea is that universal would mean that everyone would receive this benefit regardless of their financial position. But in reality, a word like national might be a better fit here given that any policy would be constrained by national borders.

More troubling for me is “basic”. This might be one of the most subjective words in the English language. Does basic mean access to a shelter, electricity, and running water? Does it also include access to healthcare? Does that healthcare just mean emergency healthcare, or does it extend to preventative care? What about access to contraceptives and reproductive health? And what about education? Would a basic income stop at elementary or high school? or perhaps it includes enough to cover a 4-year undergraduate degree?

These are big questions with big implications. And ones that are not served well by the use of ambiguous short-hand.

Philosophy

On Tuesday I was heading home from work while enjoying a podcast. While I was traversing the subway station toward the relevant platform, I began searching the Apple podcast app for the next episode that I would enjoy after the current one. I guess I was a bit nervous knowing that I would lose service in the next couple of minutes.

But the funny thing was that I was only 20 minutes into an hour-long episode. And a very good hour-long episode at that. And the ride home from the Bryant Park station is perhaps 6 minutes at most. There was virtually no chance of cell service becoming an issue during that brief window.

So I rewinded the current episode about 60 seconds to before I became distracted, locked my phone, put in my pocket, and continued peacefully on my way.

It’s so easy to become fixated with the next thing when the current thing hasn’t even run its course. It’s just like that old saying of thinking about those proverbial birds in the bush while ignoring the one you’re already holding.

My Latest Discovery

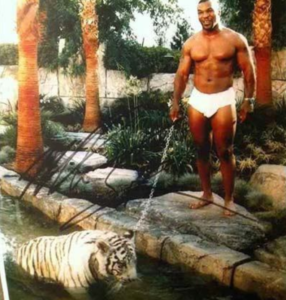

If you’re in need of some entertainment this week, check out this Mike Tyson interview by Joe Rogan a couple weeks ago. And if you’re strapped for time and only want to watch 2 minutes, I’d recommend starting around 11 minutes and 45 seconds when Mike answers the question, “What made you think you could get a tiger?”