Business & Money

Most in the tech media spend all their time writing about Google, Facebook, Amazon, and a handful of other tech darlings (not to mention the ones shrouded in controversy, a la Uber, Theranos, etc). Unbeknownst to many, there’s another tech juggernaut that rarely gets any Love. Priceline was founded in 1997 before the internet boom of the early 2000s and made its name on the “make your own price” commercials. Then when everything went bust in 2001 the company’s market value shrank to $130 million. Since then the stock has grown more than 30,000 percent and earnings have risen at a compound annual rate of 42%. That’s faster than Apple, Amazon, Google, and Netflix.

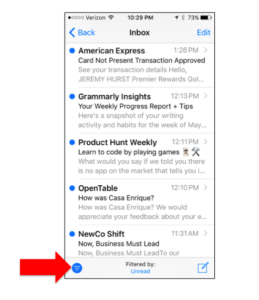

What’s even more interesting is the company’s history of deal-making. Over time they’ve acquired Kayak, OpenTable, Booking.com, and others. Booking.com happens to be the largest hotel accommodation site in the world and perhaps one of the best acquisitions ever.

What’s more, Priceline might be the largest competitor to Airbnb, one of Silicon Valley’s sweet hearts. In 2016 Priceline listed over half-a-million “alternative accommodations” (privately owned homes, apartments, etc) while Airbnb listed 3 million. While that’s only about a sixth of listing volume, Priceline has an advantage if you consider the entire travel experience. You can book your flight, hotel, and make a dinner reservation, all in one place. Airbnb has recently launched its own experiences brand but we’ve only heard rumors about flights and other travel services.

And remember what I wrote about last week, this is another one of those platform businesses with strong network effects.

Human Progress

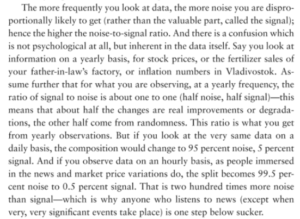

With so much hype about AI these days, it can be hard to separate the signal from the noise. As such, I tend to skip over AI pieces from main stream media outlets in favor of research and content from deep domain experts. I’ve been asked a bunch of times for recommendations on who to follow, so I thought I would share a few here.

Fei Fei Li is a computer science professor at Stanford where she leads both the AI lab and vision lab. She’s a rockstar in computer vision and played a key role in the creation of ImageNet.

Andrew Ng was chief scientist at Baidu, did a stint leading the AI lab at Stanford, was the original lead on the Google Brain team, and oh yea, also co-founded Coursera. No big deal.

Yann LeCun is the director of AI research at Facebook. Given that data, actually boat loads of data, is required to build effective machine learning models, it’s no wonder that Yann and his team at Facebook are among the best.

Philosophy

Over the last few years, I’ve been constantly working on a list of questions that define a successful day. If I can answer yes to each question on the list, I’m in good shape. Of course, there will be days where I fall short, but the idea is to have more good ones than bad. Here is the list in its current form:

Did I work on my physical fitness?

Did I work on my mental fitness?

Did I make progress towards my goals, however small?

Was I proactive with my time and energy?

When thinking about the important people in my life, did I do something to make one or more of them smile?

My Latest Discovery

I’m such a noob when it comes to travel. Here are two examples:

I just signed up for TSA pre-check. It’s awesome! No lines. I can keep my shoes on. No need to remove my computer. Game changer!

I just realized that you don’t need a specialty credit card that’s associated with a specific airline to sign up for their frequent flyer programs. I’ve been missing out on soooo many miles!!