Business & Money

4 years ago, Fred Wilson said,

“The lesson I’ve learned in my career is to invest into the post-crash cycle. When you do that, and do it intelligently, you are rewarded greatly.”

Let’s point to a few things that are crashing or in the post-crash phase:

Retail

Bitcoin

China

Today, let’s talk about retail.

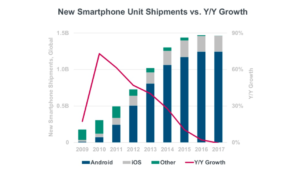

Thing one, retail is not going away. It will undoubtedly change and evolve (those that stagnate will die), but brick and mortar retail is here to stay.

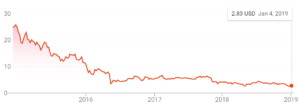

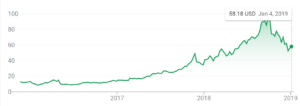

One retail stock I’ve added to my watch list is Bed, Bath, & Beyond (BBBY). To be clear, I have not purchased any shares to date. It’s impossible to time the bottom on any out-of-favor asset and, as such, I like to see positive momentum before making any purchases. But there are a few reasons I find BBBY interesting.

The first thing is that, while the stock has lost 77% in the last 5 years and profits have decreased by a similar percentage, revenue is slightly up over the same period. And when I read the earnings releases and annual reports, that decrease in profits seems to be due to an increase in SG&A expenses. So you have to dig a bit deeper.

Second, the balance sheet looks fantastic and seems to be getting better still. Inventories are down. They’re closing underperforming stores. The cash position is up to over $1B (market cap of $2.3B). And management is buying back shares at the right time, when the price is low (as opposed to tons of companies buying back stock these days at astronomical valuations).

Third, the company is making strategic investments in its future. Capital investments are up and the bulk of that is related to technology and digital transformation. They’re releasing private label brands. They’re redesigning stores and rethinking merchandising strategies.

Now, don’t get me wrong. This is not a high growth business and will likely never be. But the company appears to undervalued, and perhaps significantly so.

Human Progress

A few weeks ago, while I was in Vegas, I enjoyed a few Impossible tacos at a restaurant. They were Impossible because the “meat” is produced by Impossible Foods (I wrote about them in VIC 100).

What I found interesting was that the Impossible tacos were more expensive than all the other tacos on the menu. So in my head, I’m like, “why is that?”

Think about it. Beef is generally more expensive than chicken becomes it’s more expensive to produce. Cows require more land, more food, more water, and basically more everything as compared to chickens. So the cost difference makes perfect sense.

If Impossible Foods claims to require far fewer inputs to make their meat substitute products, why the higher price?

It could be the fact that they’re far smaller than the big meat producers and thus not operating at scale. Or, this could have more to do with marketing (price as a signaling mechanism).

But if the claims are true about production, intuition and market mechanisms would say prices should come way down over time. And that’s important because they won’t win on moral grounds. People may claim to care about animal welfare and environmental impact, but history says they care more about price and other tangible benefits. So the products will need to be cheaper or taste better, or some combination of the two.

It reminds me a bit of whales (bear with me for a moment 😂).

We used to kill tons of whales for blubber and fuel. And there was always a small contingent of people that said this was morally wrong. But that didn’t matter. Whales kept dying. We didn’t stop murdering the whales until we found an alternative fuel source, namely kerosene.

Products always need to compete on their own merits. And if you can sprinkle a bit of morality on top, all the better.

Philosophy

On Thursday, I enjoyed my monthly meeting with Excelsior (a Latin word translated as “ever upward). It’s a group of 8 great friends wherein we choose a book to read together for the month and spend the time to dive into the text and how it relates to our lives.

We kick off every meeting with life updates, wherein each person spends 5-10 minutes updating the rest of the group on something important to them (sometimes these go a good bit longer, but we’re intentional to let these run when it feels right). Sometimes people recount a compelling line of poetry, sometimes people celebrate a promotion or moving on to a new opportunity, sometimes we talk of the women in our lives, and other times about interesting investment ideas that have captured our attention.

One update this past Thursday included the mention of one member enjoying a sober February. He described how he didn’t miss the drunken nights out one bit and felt refreshed.

On my Uber ride home, I was thinking about what he said when a new phrase popped into my mind (turns out it wasn’t so new). You often hear about FOMO, or the “fear of missing out.” But the phrase that popped into my mind was JOMO, or the “joy of missing out.”

I then did a quick Google search and it turns out that I wasn’t the first to come up with JOMO. One search result yielded a beautiful poem that I thought I’d share with you all this evening:

JOMO (The Joy of Missing Out)

–By Michael Leunig

Oh the joy of missing out.

When the world begins to shout

And rush towards that shining thing;

The latest bit of mental bling–

Trying to have it, see it, do it,

You simply know you won’t go through it;

The anxious clamoring and need

This restless hungry thing to feed.

Instead, you feel the loveliness;

The pleasure of your emptiness.

You spurn the treasure on the shelf

In favor of your peaceful self;

Without regret, without a doubt.

Oh the joy of missing out.

My Latest Discovery

A few weeks ago my wife and I were roaming around the Midtown East area of New York City. When it came time for her 3 pm doctor’s appointment, I was left alone with about an hour and a half to kill.

I stumbled across a jazz bar called Fine & Rare and decided to check it out. And I’m so happy I did! The music was somehow relaxing and energizing at the same time, and the whiskey selection was exquisite.

So I sat down at the bar, ordered a Lagavulin 16, and enjoyed about 50 pages of a book called The Social Singularity.

Quite a lovely afternoon!