Business & Money

Early this year I sold my Tesla (TSLA) stock. It had gone up a bunch over the years and the markets were (are) feeling frothy, so I decided to cash in and walk away with the gains. Of course, it has gone up an additional 20% this year and I’m sitting here feeling like an idiot. That said, I’ve noticed a couple other things that I thought were worth sharing.

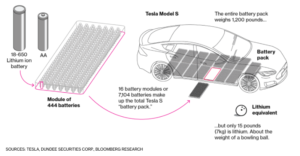

The first is that there are a couple of foundational pieces of technology that are large drivers of success for Tesla, one being the lithium-ion battery pack.

There are 7,000 individual batteries in one battery pack. And now, given Tesla’s success and a growing global consciousness about climate change, you have every other major car company saying that they will switch all models to electric, and thus lithium-ion battery packs, in the next 5-10 years (unless some other breakthrough comes from left field). So lithium will be in very high demand. If TSLA feels too risky for you as an individual stock, I’d recommend the Lithium ETF (LIT) which gives you exposure to the entire category (lithium miners, battery manufacturers, EV companies, etc) as a hedge against any one specific bet.

The other key factor I was referring to driving Tesla’s success is, of course, artificial intelligence, but I write ad nauseum on that subject here on VIC so I’ll leave it alone today.

The other thing I’ve noticed as a result of selling TSLA is that there is a lot of talk about the market and individual companies being overvalued. And in some respects that is true. If you use traditional valuation metrics like P/E, EV/EBITDA, and the like to compare a company to historic multiples in the category, then yes, the market is expensive. But what I’m realizing more and more is that there are a lot of things that aren’t captured in ratios and financial statements. If you look at Amazon’s filings, where is Jeff Bezos. He’s not on there. There’s no entry for “visionary CEO” on an income statement or balance sheet. There are no entries for durable competitive advantage or strong network effects. I believe it’s far more important to think about the fundamentals of the business, rather than a simple mathematical exercise, and why it will be successful in the long run. Most of the great companies of our day are always “overvalued.” My thinking has shifted considerably to take “overvalued” as a strong buy signal. Perhaps the term is just horseshit altogether.

Human Progress

I’ve gotten the question about how to participate in ICOs a bunch of times, so I figured it was time to write a quick blurb. For the uninitiated, ICOs (initial coin offerings) are a means by which startups and blockchain-based projects raise capital. In short, the company initiates a crowd sale of tokens (think Bitcoin or Ether, but specific to that company or project) to the public. This year ICOs have raised over $1 billion, with the largest individual sales raising over $200 million (Filecoin and Tezos have been the largest and most talked about).

So how to participate.

First, you have to acquire Bitcoin or Ether. The easiest way to do so is via Coinbase, the leading crypto exchange and wallet. You just open an account, connect a bank account, and purchase your token of choice. Keep in mind that, because this purchase happens via a traditional bank, the transaction will take a few days to settle. So if you want to participate in an ICO, you’ll want to purchase Bitcoin/Ether a week in advance.

Second, you’ll need to transfer your Bitcoin/Ether to a wallet you control. With Coinbase, you don’t own your private keys, so that won’t work. The way ICOs work is that you send tokens to a specified address, then a smart contract is executed and your desired tokens are sent back to your address. You need your private key in order to access those tokens. I use My Ether Wallet for this.

Third, participate in the ICO by sending your Bitcoin/Ether to the appropriate address. The company hosting the sale will provide the address where the funds are being collected during a specified window of time. Be careful here, though, because hackers and scammers will try to replace the correct address with their own, stealing any funds sent to their address, with no recourse. They’ve been successful to the tune of millions of dollars.

Last, and especially if we’re talking about considerable sums of money, you’ll want to store your tokens in a cold wallet, aka one this isn’t connected to the internet. Hardware wallets are best for this, with Trezor and Ledger being the most popular.

Hopefully this helped. Be careful out there!

Philosophy

I often write here on VIC about the positive effects of the internet and technology. But one not-so-positive side effect is that we increasingly live in a world of instant gratification. If you want to go on a date, just swipe right and viola! One date coming right up! Hold the awkward meandering up to a group of strangers in the park. Hungry? Not for long with Seamless or GrubHub at your fingertips. Feeling down, just post a picture to Instagram so everyone can like it and stroke your ego.

At every turn, it seems, every need can be met in an instant. The problem is, when it comes to important things like meaningful relationships or fulfillment at work, there’s no quick fix. Substantive interpersonal connections require a sustained and genuine interest in another person’s affairs. If you want to find meaning at work, there will likely be a ton of long hours, frustrating conversations, and uncomfortable situations. And while none of these are fun in the moment, I’d say they’re almost a requirement for anything worthwhile.

This might be the primary reason that people ascribe laziness and entitlement to millennials. You have an entire generation of people that are expertly trained in instant gratification. How you can you blame them (us) for expecting to get exactly what they want when they want it.

And what’s more, many of the needs currently met by technology were previously met by other people. Individuals look to social media for their self-esteem and their sense of well-being, instead of relying on friends and family. This likely leads to underdevelopment in communication faculties and an inability to cope with stress in effective ways.

What you have here is the perfect recipe for what I’ll call the millennial psychosis. And given that the pervasiveness of technology in our lives is sure to increase over time, the future looks rather bleak.

I wish there was some easy answer or magical cure, but there isn’t one in sight. That said, I AM a firm believer that making space in your life to be free of technology and instant gratification is a good start.

My Latest Discovery

I was recently speaking to a friend who happens to be an iOS engineer. As we were walking side by side, he noticed that I had pulled my phone out of my pocket, and was in the process of force quitting a bunch of apps to conserve battery life. He proceeded to tell me that this was futile. He claimed that the power required to reboot an app from scratch was likely equal to, if not greater than, the power used by an app sitting idle in the background.

I’ll have to fact check this one, but an interesting insight none the less.