Business & Money

In investing you often hear the disclaimer, “past performance does not guarantee future results.” And I get why it exists. You don’t people making investment decisions solely based on the fact that performance has been strong in the past, without considering any other factors.

But, in reality, past performance does often suggest that things will continue to be good in the future. I’m a big believer that winners usually keep winning. The best teams in sports usually keep winning. The best artists usually continue pumping out hits. The best VC firms get access to the best deals. And the best companies often continue to grow and take market share. In fact, the “momentum” investment strategy is centered around this core idea.

It’s not a complicated idea to understand. Great companies attract the best talent, hoards of capital, and organic attention in the media. The success feeds on itself.

So don’t let the disclaimer fool. I believe winners keep winning and I cherish opportunities to add to my winners. #BTFD

Human Progress

“Give me liberty, or give me death!”

These famous words were uttered by Patrick Henry in 1775 before the Second Virginia Convention. In doing so he was making an emboldened declaration that the United Colonies should be liberated from the Kingdom of Great Britain.

Well, asketh and thou shall receive! It would be under one year until the Declaration of Independence was signed in July of 1776.

I stand (well currently sitting) here some 243 years later and would like to make a similarly bold proclamation.

Give me Libra, or give me death!

Ok, it’s not my proclamation, but that of Mr. Zuckerberg (Mark Zuckerberg, CEO of Facebook). And call me dramatic, but we may be at the dawn of an equally historic moment.

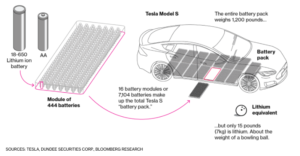

A couple of weeks back, Facebook pulled the curtain back on its foray into the world of crypto and financial services. The company will be launching a new cryptocurrency called Libra. Well, more accurately, Facebook, in association with 28 other leading companies around the world, has created the Libra Association, which will be the governing body of the Libra cryptocurrency and the underlying blockchain with the same name. In other words, the digital currency will not be controlled by Facebook alone, but rather by the association.

Pulled directly from the white paper (I recommend reading the entire document),

The world truly needs a reliable digital currency and infrastructure that together can deliver on the promise of “the internet of money.” Securing your financial assets on your mobile device should be simple and intuitive. Moving money around globally should be as easy and cost-effective as — and even more safe and secure than — sending a text message or sharing a photo, no matter where you live, what you do, or how much you earn. New product innovation and additional entrants to the ecosystem will enable the lowering of barriers to access and cost of capital for everyone and facilitate frictionless payments for more people.

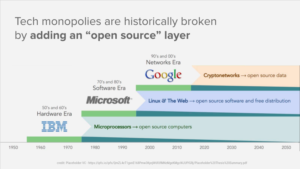

So why do I believe that this might be a historic moment? First, let’s zero in on the phrase, “the internet of money.” As a corollary, think about what the internet did for the flow of information. In the 90s, many referred to the internet as the “information superhighway.” That is, the flow of information was democratized. Given you had a computer and an internet connection, it became trivial to publish and distribute information. You could freely communicate with anyone across the globe within seconds. If the printing press wrested power from the church, the internet wrested the same from governments, media conglomerates, and incumbent power structures.

The key thing to note here is that there was a wholesale shift of control from those that controlled the supply and distribution of information, to those that controlled demand. So when I read the phrase “the internet of money,” the thought is that the internet should do for money exactly what it did for information. Namely, create a fully open and democratized system that empowers more people. But I don’t believe we’ve seen for money what we’ve seen for information.

The obvious place to start, and the first place crypto bugs often look for a use case, is the underbanked and disenfranchized. If you live in a setting that has poor payment infrastructure or is ripe with government corruption, an internet for money would be an obvious step forward. Similarly, any locale that is vulnerable to wild currency fluctuations would be an obvious beneficiary of an internet of money based on a stable digital currency.

However, while the above point is an important one, many in the west won’t care. One of the most common questions I hear people ask is, “Why would I care living in the US? We have great payment infrastructure and a stable currency.” True and true. But I’ll highlight a few examples of where there is still friction in the payment system. If you have family in one of those vulnerable locales I mentioned above, sending money to your relatives is far harder than it should be and carries high fees. Traveling is another friction point. Over the last few months, I’ve spent time in France, Korea, and Japan. I often couldn’t download a local ride-sharing app due to lack of a local bank account. Not all merchants accepted cards, so I was often forced to use the local currency. That brought with it ATM transaction fees and, of course, you get gouged in the airport on the way home when you want to convert back to USD. If you want to start a company, you might look for bank financing or venture capital, which is out of reach for many. So, while we do have it good here in the US, friction points abound.

The second point I’ll point to here is the formation of the Libra Association. Here’s a screenshot of the association members at this point (Facebook has stated a goal of at least 100 members when Libra launches next year):

Many thought that Facebook would try to launch a digital currency fully controlled by Facebook itself, but that wouldn’t make a ton of sense given a core tenant of blockchain technology is decentralized governance. However, with fully decentralized systems like the bitcoin blockchain, there are massive drawbacks in terms of efficiency and scalability. Bitcoin bears love pointing out the fact that it can only handle 7 transactions per second and that governance is a nightmare, leading to forks and slow iteration. But you might say this fact is as much a feature as a bug. When transactions need to be validated across a large number of decentralized nodes, you get slow throughput and wasted energy. The polar opposite of a blockchain is centralized database owned by 1 company. So you get perfect governance (a consensus of 1) and no scalability issues (think about how many events [posts, comments, etc.] are processed every second across Facebook’s family of apps today).

So, in effect, Libra sits in the middle of those extremes. It’s not fully decentralized given the association has a relatively limited number of members, but gains from the efficiency of having a more streamlined governance structure and being able to leverage the computing resources of leading global companies.

Finally, digital currencies today have a limit on adoption given how hard they are to use. Exchanges don’t support every currency. You can’t transact in many places. To put it simply, the user experience is shit. Facebook has the ability to change that in a massive way. If digital payments and financial services become easily available within Whatsapp, Facebook Messenger, and Instagram, you instantly enable billions of users across the globe to leverage Libra across a whole host if different use cases (P2P payments, e-commerce, etc).

And this brings me back to a point a made earlier. Above I said, “the key thing to note here is that there was a wholesale shift of control from those that controlled the supply and distribution of information, to those that controlled demand.” What I mean by controlling demand is controlling the relationship with the consumer. Facebook owns the relationship with all of its users, so publishers and advertisers must play by its rules. (the same is true for Google, Netflix, Amazon, and Apple)

With the association, Facebook has fully embraced that they will not be allowed to control the supply and/or distribution of a global digital currency. And they don’t need to. They are making a bet that they will be best positioned to control demand. That is, they will offer the best user experience and easiest on-ramps to using the currency.

243 years ago, we got the founding of what is now (arguably) the world’s leading global superpower and the dawn of a new era. And, I imagine that, if you could have asked people what they thought at the time, no one knew it. I wonder if we are witnessing something similar today.

Philosophy

A few weeks ago I visited the mountains of Pennsylvania for a friend’s birthday. On one particular day, our group was in the car headed to enjoy a few rounds of paintball. The cell coverage was spotty in the area due to the remote location. As a result, the GPS would often update on a delay while searching for a signal. So as we were nearing our destination, I missed a turn because there had been no instruction to do so. A few moments later, I heard the all too kind GPS lady say “recalcualting,” and we were back on track in short order.

I point this out because I love when technology provides a good model for behavior. These days, it’s common for people to complain about all of the downsides of technology. Loss of privacy, misinformation, etc etc. But sometimes, when you pay attention, you find hidden treasures.

What I love about the kind GPS lady is that she never gets angry. She has one goal and one goal only, to get you safely to your destination. If you miss a turn, she simply adjusts to the mistake and provides a new route.

What’s interesting here is that we often do the opposite with the people we love most. We become frustrated or short-tempered when they make a mistake, and quickly forget that we want nothing but the best for them.

I point this out because I’m as guilty as anyone of doing this. I do it with my grandmother. I do it with my wife. I do it my dog.

I think we would all be well served taking a page from the GPS lady’s book on how to treat people, especially those we care the most about.

My Latest Discovery

My friend David recently played this song for me. Have you ever been having a conversation, but suddenly you can no longer focus on the words swirling around you because the beat was too intoxicating? That’s what happened to me while this one was pulsing through the speakers. Do yourself a favor and give it a spin ASAP!