Business & Money

I’m not sure where it’s from, but there’ this metaphor in business and in life that involves rocks and sand.

Let’s say you have a pile of rocks, some big and some small, a pile of sand, and a jar. If you first add the big rocks, then the small ones, and finally the sand, everything will fit into the jar.

Conversely, if you first add the sand, then the small rocks, and finally the large ones, you won’t have enough space to fit everything into the jar.

When you start with the rocks, the sand fills all of the gaps and crevasses perfectly, but in the reverse order, you end up with air pockets between the rocks.

The metaphor is simple but profound. The big rocks are the things that really matter in business and in life. They are the complex things that you cannot complete in an hour or a day. They require deep thinking and a long-term perspective.

You might refer to the sand as “small wins.” It’s when you spend all morning responding to emails and hit inbox 0 by lunch and get that feeling of accomplishment. Meanwhile, you haven’t made any progress towards your important goals.

In life, the sand is the short term dopamine hits that you get from instant gratification. It’s when you wash the dishes as procrastination instead of studying for the LSAT or working on your book.

Don’t start with the sand.

Human Progress

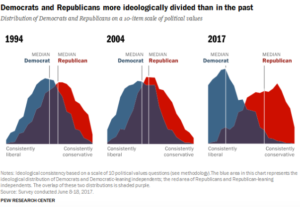

You often hear people blame Facebook for the outcome of the 2016 election. And I agree that It’s Facebook’s (and Google’s) fault. But not for the reasons you hear about.

The reasons you most hear about have to do with “fake news” and Russian ads. Both are important topics, but I believe it to be intellectually lazy to stop there.

Before Facebook and Google, political power was implicitly reliant on the media. If you wanted to win the primary for either party you needed money for advertising or you needed earned media. That is to say that you needed major media companies to talk and write about you on TV, print, and radio.

And in order to get enough money or attention, you need to be in a position of power that was enabled by the party. You needed relationships with leading political donors and close connections in media.

Plus, you have to remember that media coverage wasn’t predicated on writing/saying what people wanted to read/hear. Instead, it was predicated on owning the means of delivery. It was predicated on being a big media conglomerate with printing presses, delivery trucks, and/or television networks.

The internet made all of that obsolete. It destroyed the gatekeeper function of media companies. Now, attention is predicated on how much engagement you can drive, that is how many clicks, likes, and video views you can drive. So feeding into confirmation bias and sensationalism is the name of the game.

Now the media companies are subservient suppliers to the big platforms and have to create content based on their dictates. They have to compete based on those engagement metrics I just mentioned a moment ago. So they are incentivized to give someone like Donald Trump more coverage and airtime. Not based on the merits of his viewpoints, but because he drives more attention, which drives more ad dollars.

So I’m not so much blaming Facebook and Google specifically, but rather blaming the internet more broadly and the business model that has come with. It just so happens that Google and Facebook have won the internet and so you can use either company as a stand-in for the larger issue.

The problem, though, is that giving people what they want is not always a good thing. If you let a child control their diet, they’d likely eat junk food and drink soda exclusively. So adults have to temper those desires and communicate the importance of eating well.

So I guess the question becomes, what does adult supervision look like on the internet?

Philosophy

Riding jet skis is one of my favorite things to do.

One interesting thing about jet skis is that you have more control over the machine the faster you go. It’s counter intuitive. Your inclination is to slow down when you get scared, but doing so too quickly is how people get thrown violently from the machine.

This is especially the case when you’re trying to turn. You have to keep the throttle engaged throughout the turn for maximum control.

It’s very similar to riding a motorcycle or even a bicycle in that way. When you first learn, you feel like going slow is the prudent thing. But it’s not. Balance and control again come with higher speed.

And it’s interesting because, if we circle back to where we started, you sometimes have to slow down and take a step back to really make progress on the big rocks.

But jet skis, motorcycles, and bicycles seem to say the opposite. Perhaps what we’re talking about here has to do with avoiding “analysis paralysis.” At some point you just have to make the decision and go for it.

My Latest Discovery

I’ve written hear before about my love of many different podcasts. And given that I’ve worked in and around the media and advertising industry for a while now, I’m just as interested in the business side as I am in listening to podcasts themselves.

The industry went from about $170 million in 2016, to $317 million in 2017, and is expected to hit roughly $650 million by 2020.

If you find this space interesting, I’d recommend checking out the

Hot Pod email newsletter. There’s a free weekly edition, and also a paid version if you want to dive deeper.