Business & Money

A couple of weeks ago I was on a plane preparing for takeoff. As I set there in my seat, there were a few investment ideas swirling around in my head as the flight attendant droned in the background about oxygen masks. As I gazed out the window thinking about how I might reduce some risk in my portfolio (I’ve been shifting from growth toward value as valuations have continued to climb), there was a thunderstorm brewing on the horizon. There were horizontal lightning strikes flashing through the sky which I found remarkably beautiful.

The mix of lightning strikes and thoughts about risk reminded me of an analogy I heard a while back. I don’t remember exactly how it went or where I heard it, but I’ll do my best to convey the gist.

In a lightning storm, there is a chance that a specific lightning strike will ignite something on the ground and lead to a fire. Californians know this all too well.

But risk is not the probability of a lightning strike on a specific place. Rather, risk is better characterized by the amount of dry plant matter on the ground. When there is little dry plant matter, the probability of a lightning strike leading to a fire is fairly low. By contrast, if you have an extended period of drought, leading to the accumulation of dried plant matter, the chance of fire resulting from a lightning strike becomes far greater (irrespective of where the strike happens).

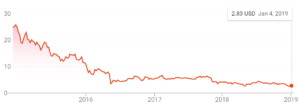

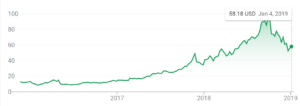

Equate that to today, and I’d say we have a lot of dried plant matter laying around. Political unrest at home. Political unrest abroad. Lofty valuations in public markets. A global bear market (with the exception of the US). Extremely low interest rates, meaning the Fed doesn’t have a ton of recourse to act should they need to. Inverted yield curves. And on and on and on. So I believe we have elevated risk levels.

As a result of the heightened risk, I’m playing a lot more defense than offense at the moment. My cash position has risen to 33% from around 15% a year ago. Add another 7% of what I’ll call extremely safe bets (GLD, BRK.B, MKL, DIS, AAPL, GOOGL). And of what remains, I’m putting more emphasis on healthy balance sheets, consistent earnings growth, and profitability. Don’t get me wrong, I’m still a techno-optimist and still own a number of growth names (ETSY, TTD, MELI, SHOP, TDOC), I’m just not adding to those names at the moment.

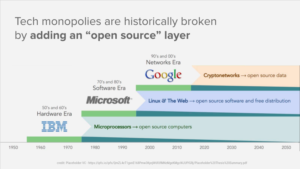

Human Progress

The web browser was an incredible thing for innovation and technological progress. Before it came onto the scene, Microsoft ruled the world because it controlled the operating system. And due to that control, app developers basically had no choice, but to develop apps on the windows OS. To develop for a different operating system was to severely limit your chances of reaching tons of end users and thus building a business of any significance.

But the browser changed that. It meant that it didn’t really matter what type of hardware you purchased and what type of OS came pre-installed. It leveled the playing field. As long as someone had an internet connection and a browser, they could access web-based applications. This state of affairs allowed for companies like Amazon, Google, Ebay, Facebook and many others to thrive and wrest some power from Microsoft (the fact that Microsoft is once again the most valuable company on the planet notwithstanding).

Keep this in mind as we slightly change topics. We’ll be circling back to the browser and its significance.

Many of you know that I’m currently working with a friend to get a software business off the ground. And part of that equation involves a mobile strategy, given that mobile is taking an ever-increasing share of web traffic. And if you’re in the US, that means ensuring that your software shows up in the Apple App Store if you want to ensure easy access and maximum distribution.

If you’ve ever tried to publish an app to the App Store, you’ll know that it must go through a review process. An unbeknownst to many, this is a human review process wherein every app is reviewed by a human being. And broadly, I’d say this is a good thing. Apple is playing a gatekeeper role to protect consumers by ensuring that malicious software doesn’t make it into the store. But there’s also a downside. If you operate a company and you compete with Apple, your apps must also go through this review process. And not only does Apple get to review the apps, they also take a 30% cut of your revenues for providing this service.

This situation lies at the center of Spotify’s recent complaint against Apple filed with the European Commission. Spotify is suggesting that Apple is engaging in anti-competitive behavior because 1) it claims that Apple frequently rejects its app upgrades (degrading its customers’ user experience), and 2) Apple takes a 30% cut of Spotify’s revenues. It’s not that the 30% cut, in and of itself, is a bad thing (remember, the role that Apple plays as a middle man has value). But rather, Spotify’s main competitor is Apple Music. So given that both Apple and Spotify must pay a huge portion of their revenues to music labels and artists, as they should, to allow Apple to then take an additional 30% of revenues from Spotify does not leave them with much capital to operate the business, market to new customers, and the like. Thus, Apple has an inherent competitive advantage.

But let’s come back to the power of the web browser. It seems many developers these days are opting to build what are known as “progressive web apps,” as opposed to native mobile apps. From Wikipedia:

Progressive web applications (PWAs) are web applications that load like regular web pages or websites but can offer the user functionality such as working offline, push notifications, and device hardware access traditionally available only to native applications. PWAs combine the flexibility of the web with the experience of a native application.

There are a couple of important things to note about PWAs (likely many more, but I’m not a developer).

First, you usually install them by navigating to a company’s mobile site. When you land there, you get the “add to home screen” dialog box. This adds an icon to your phone’s home screen so it appears just like any other app. But importantly, you have circumvented the App Store and thus don’t have to give up any of your revenue to Apple.

Second, from a development standpoint, things are far more simple. You develop one PWA that works for every browser, OS, and device type. So you don’t have to worry about developing an Android app, iOS app, lengthy review processes, and accounting for older device models that only support older versions of the OS.

For these reasons, my technical co-founder has opted to build a PWA for our mobile experience. Makes a ton of sense to me.

So again, it seems the browser may be playing a key role to level the playing field and wrest power from the giants (the fact that the leading browsers are owned by the giants notwithstanding). And I think that is a good thing that will ultimately lead to more innovation and more competition.

Philosophy

I’ve been meaning to write about something for a long time. But I haven’t done so out of fear and shame. But reading The Gifts of Imperfection by Brene Brown has illuminated the fact that embracing shame and vulnerability are what courage is all about. So it’s time to get this weight off my chest.

To put it simply, I’ve lied to many of you for years. I feel terrible about it and it’s time to put an end to the lies.

Up until age 18, basketball was a big part of my life. I wasn’t some superstar athlete, but I took the sport seriously and was confident in my ability.

But that all changed when I went to college. There were a number of schools (primarily division 3s, a handful of division 2s, and one division 1) that recruited me aggressively and where I could have attended on a full ride and continued to have basketball play a major role in my life. But when I visited New York City, I was enthralled by the lights and the energy. I was spellbound. Smitten even. She had me before she said hello. 🤤😍🤩🤪

In other words, NYU was a no brainer. The fact that it offered a top 5 undergraduate business program was just a cherry on top.

Unfortunately for me, I wasn’t good enough to make the team. Plain and simple (I think this is the first time I’ve set this aloud to myself or written it down). But for a long time, I embraced a multitude of excuses.

First was the fact that the coach that “recruited” me was nowhere to be found when I arrived for freshmen year (still unsure if he left or was fired). I put recruited in quotes because I don’t want to embellish the facts any longer. I received a few recruiting letters and went on an unofficial visit to meet the team, but nothing glamorous.

Second was the fact that the head coach favored a “different style” of basketball. There weren’t many black guys on the team and shooting threes seemed more important than getting out in transition or playing the pick and roll. But again, just another excuse.

I just wasn’t good enough and the team was not in need of another guard.

And not only did I not make the team freshmen year, I again tried out sophomore year and didn’t make the cut. I largely kept this a secret to avoid the embarrasment of telling people about it, then failing.

At the time I didn’t make a big deal about it or spend much time reflecting. The story I told myself was that I would have more time for partying and more time for studying.

But the reality is that this was one of the biggest failures and disappointments of my life. And it was a huge blow to my confidence and my feeling of self-worth. So much so that I’ve lied about it ever since. To this day, many people believe that I played basketball in college (because that’s what I told them). For those closer to the story or with a better chance of finding me out, I told them I played, but got hurt early in my collegiate career and thus decided to focus on my studies. I wouldn’t be surprised if there are a couple of other fabricated versions of the story floating around that I no longer remember.

But long story short, lies, lies, and more lies. I lied because I was ashamed of my failure and have always struggled to embrace vulnerability.

I’m writing this to apologize for all of the lies and to take a small step toward better dealing with shame.

My Latest Discovery

If you subscribe to AT&T as your wireless carrier and you have an unlimited data plan, it includes free access to one premium entertainment service. The options include HBO, Cinemax, Showtime, Starz, Amazon Music Unlimited, or Pandora Premium.

I chose HBO. Duh! 😉