Mary Meeker put out her annual internet trends report a few weeks ago. It’s a whopping 294 slides, but I’ll do my best to pull out a few nuggets I found interesting.

Business & Money

This is one of my favorite slides…

It makes me think about a few things.

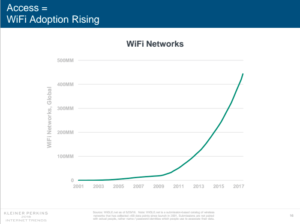

With time spent on digital media going up, the explosion of mobile video and streaming, I find it hard to imagine that mobile networks can handle the increased usage. As such, it seems logical that more traffic will have to be offloaded to wifi.

A stock of I like a lot in this regard and have held for quite some time is Boingo Wireless (WIFI). They’ve taken their airport model and replicated it successfully at stadiums, military bases, and many other places.

That said, there will, of course, need to be heavy investments in mobile data infrastructure in parallel. This is evidenced by the big telcos making heavy investments in 5G, and you can also see it reflected Trump’s desire to beat out China in this area.

So I’ve also been tracking the large REITs that own the market for cell towers. Those are Crown Castle (CCI), SBA Communications (SBAC), and American Tower (AMT). I haven’t made any moves on these 3, but they’re on the watch list.

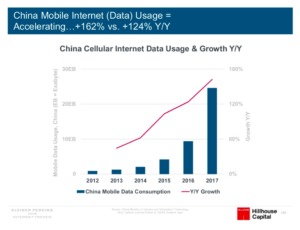

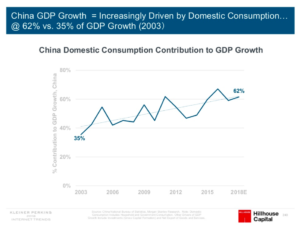

If the following slide is any indicator, I may look for international exposure.

Human Progress

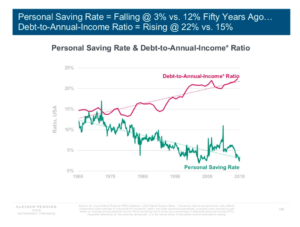

If there’s one slide that scared me, it was this one:

If that doesn’t make you uneasy, then I don’t know what will.

Your personal savings rate is the ratio of the amount of money that you put aside for savings divided by your disposable income.

Your debt-to-income ratio is calculated by taking the sum total of annual debt payments (credit cards, mortgage, etc) and dividing that by your annual income.

My personal savings rate sits around 12%, while debt-to income sits around 21%.

Can’t hurt to spend a little time thinking about where you sit vs these benchmarks.

Philosophy

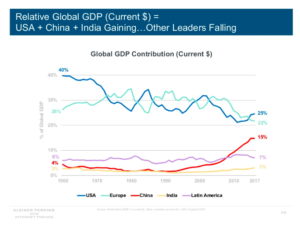

I think I may have figured something out about what’s motivating Donald Trump.

Take a look at slide 214…

It won’t be long before those lines meet.

Are you familiar with Thucydides’ Trap? It’s the pattern of stress that arises from a rising power threatening to displace the incumbent power. Thucydides was an Athenian General and is well known for his writings about the Peloponnesian Wars fought between the two leading powers of Ancient Greece, Sparta and Athens. He suggested that, despite many flashpoints and disagreements between the two sides, the primary reason for conflict was fear from the established power, Sparta, about the rapidly growing strength of Athens.

That dynamic seems to describe US-Sino relations to a tee.

Trump is terrified of China, and everyone else for that matter. Trade wars, America first, anti-immigration. You know the story.

Xi Jinping is reducing China’s dependence on foreign goods.

He’s making heavy investments in AI & technology sectors (USA winning 11-to-9 today, vs 9-to-2 five years ago).

He’s flexing his muscles in the South China Sea.

If you were casting a movie called “The Return of Thucydides,” you’d be hard-pressed to cast better than Trump vs Xi. This one should be a thriller!

My Latest Discovery

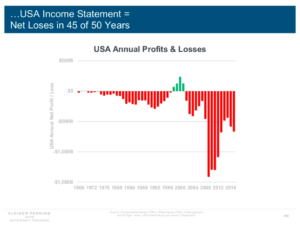

I knew we were operating at a loss, but I didn’t know it was this bad…

Which statement is more true:

1 We’re doing a terrible job.

2 Money isn’t a real thing (when operating at scale).