Business & Money

Take a look at Best Buy and Home Depot over the last year:

At a time when most retailers seem to be hemorrhaging, these guys are both trading at all times highs. This fact reminds me of 2 key points in investing:

It’s not an abstract philosophical game. Regardless of what people are saying, you simply have to think deeply about the business and analyze the numbers. It’s purely rational.

Second, and more importantly, when everyone is running for the exits, it’s a great time to look for cheap opportunities to buy. When the housing market crashed, it was a great time to buy real estate. After the internet bubble burst, great engineers and companies could be acquired for next to nothing.

If investing was about consensus, everyone would be rich.

Human Progress

I want to talk about cryptocurrencies and the underlying technology today. But before we dive in, I realize I’ve written on this subject before without providing adequate context and background to why it’s really important.

First, let’s consider banks. Banks have essentially unfettered control over money. They can print it (causing the value to fall). They cash restrict your access to it (e.g. in the case of a run on the bank = close banks when too many people are attempting to withdraw cash). They prey on the poor with myriad fees and predatory loans. The list goes on and on. And the best part, when they screw up, there are basically no repercussions (hence the term “too big to fail”).

Long story short, the incentive structures are all messed up. And given that these centralized institutions control our financial system, we’re basically forced to simply sit on our hands and pray they do the right thing (don’t hold your breath).

It is here that we arrive at the central tenant of the blockchain (the technology behind cryptocurrencies): it’s decentralized nature. There is no central entity (person, company, government, etc) that controls the entire system. Instead you have a distributed system (think ledger or database) where each entry is verified by lots of independent and self-interested parties (“miners”). As a result, you have inherent trust baked into the system. All participants rely on all other participants for the safety and integrity of the system. Incentives are beautifully aligned. (The implications go far beyond money, but this core tenant provides enough context for now)

So why are we revisiting the subject this week? Because of the price action of course.

This past week, 9 different people hit me up asking where/how to buy cryptocurrency. And many were people completely outside of the crypto.. actually the technology industry altogether. This is a telltale sign that we’re in bubble territory. Speculators and uninformed consumers are artificially inflating the value of cryptocurrency right now. And moreover, we don’t have any mainstream consumer application that would equate to higher demand (and higher prices as a result). It reminds of the dot-com bubble of the early 2000s when regular people were sinking their life savings into internet stocks, only to have it all evaporate overnight.

But the dot-com bubble is a prudent analogy for another reason. While companies were going bust left and right, many were actually incredible ideas that would later become valuable in their own right. Remember WebVan? It was FreshDirect before FreshDirect. Or what about the spectacular failure of Pets.com? Just a few months ago PetSmart acquired Chewy.com for $3.35 billion. It’s too bad that being early is synonymous with being wrong.

Similarly, I am a blockchain bull all day every day. It seems obvious that this technology will be absolutely revolutionary. But how many real consumer applications are viable today? Maybe a few. But there are a ton of things that need to be figured out first. What’s happening right now is speculation, plain and simple. Don’t be a sucker! If you want to get involved, park 1-2% of your portfolio in a secure crypto wallet and let it sit there for the next 10 years. In the meantime, it’s a good time to start educating yourselves about what’s coming.

Philosophy

So I wanted to show you my toaster:

You’ll notice that the power is set to level 5. This is a recent change. Up until last week, it was set to level 3. I think it came that way when I bought it. And level 3 was a great setting. It cooks waffles perfectly. The only downside is that you to run it twice to achieve said perfection. So when the waffles pop up, I would simply push the button down again for one more cycle and viola. Perfect waffles.

One day last week my fiance noticed this pattern and asked, “why don’t you just increase the power setting so that you only have to run it once? Wouldn’t that be faster?”

“Blasphemy,” I thought to myself. I already had a fool proof system of cooking waffles.

For some reason, I kept thinking about the toaster at random moments throughout the day. Of course it would be better to find the optimal power setting, but that would force me to venture into uncharted territory (a.k.a. untested power settings).

The next morning I decided I was in a risk-taking mood. I switched the power setting to 6 and pushed the button down. It was a grueling 90 seconds of weighting. Then pop! They were too done! Not burnt per say, but more done than I preferred. I knew I should have stayed with my system!

The next morning I was at it again, but with level 5 this time. To my surprise, the waffles were perfect. That wasn’t so bad after all. One false start the day before, but now back on solid ground.

While this is a pretty trivial example, fear of change is a real thing. I spent almost 4 years avoiding the power setting on a toaster due to fear of change. If an obstacle this small can cause such cognitive dissonance, one can only imagine what happens when larger ones present themselves.

I appreciate my toaster for this much-needed reminder.

My Latest Discovery

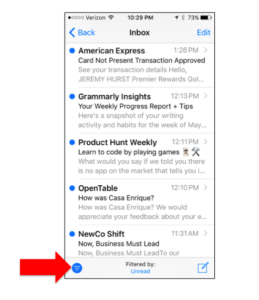

I’m either an oblivious idiot, or you will thank me effusively. Did you know that this little icon filters your inbox by “unread.”

I’ve wondered so many times why there was no easy way to do this. All the while, it’s been right here in front of me.

Question Of The Week

Whenever I have a dream, I tend to journal about it the next day to parse it for meaning. I’ve always felt that dreams were a great way to listen in on your unconscious mind. What do you think? Do you place any value or meaning in your dreams?